As the world of modern work continues to evolve and change, employees are increasingly seeking opportunities to temporarily work from abroad. Although employers often acknowledge the opportunities and benefits of permitting this, they struggling with the challenge of accommodating remote work requests and ensuring continued compliance with tax and legal regulations.

Global HR platform, WorkMotion, invited leading German companies to discuss this issue in a recent event. This article explores the insights shared by specialists, including best practices and experiences.

Powered by: WorkMotion, BPM, PMA

The emergence of workations as an employee benefit

Workation, a portmeanteau of “work” and “vacation”, have generated substantial attention in German media. Leading publications like Frankfurter Allgemeine Zeitung, Bild, Tagesschau and Focus have all covered stories of companies permitting their staff to work from abroad. This sudden media spotlight on the topic stems from the fact that a significant portion of DAX-listed companies like Bosch, Continental and Siemens have embraced the concept and granted employees the opportunity to temporarily work from overseas for personal reasons.

These companies have adopted the innovative benefit of workations despite associated compliance risks and administrative complexities. According to Tobias Nehls, Head of Global Mobility Management at Siemens, workations have rapidly become a staple employee benefit and although companies should design policies in a comfortable way, it’s impossible to ignore this hot topic.

Exploring workation policies with employers

Companies like Siemens have slowly started rolling out workation policies to a portion of their European workforce, but are taking it step by step in order to better design and optimise processes for the whole company.

Other companies like Volkswagen, Mercedes-Benz and Celonis are still working on defining their approaches to this benefit. Kirsten Bildhauer, VP of People & Culture at Celonis, notes they do not yet have an official policy for temporary remote work from abroad, but are adopting a pragmatic approach to accommodate employee requests during extended vacations or family visits.

Setting time limits on temporary remote work

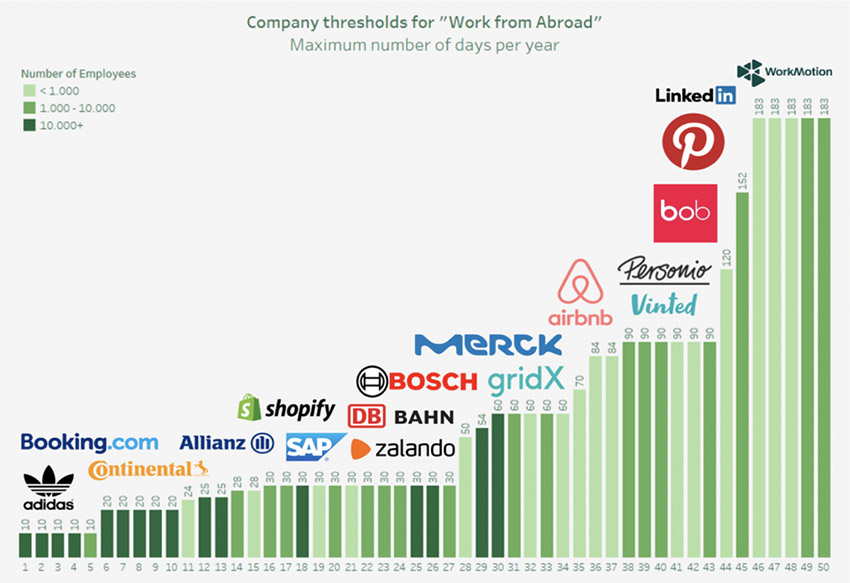

Policies on temporary remote work from abroad vary across companies but often share one common element – a duration limitation. Most policies will include a threshold, typically a maximum number of working days allowed per tax year. Both companies and employees need to recognise this need for limitation and get the right balance between employees desires and company compliance requirements.

As shown below, the thresholds different companies currently hold vary from 10 working days at companies like Adidas and Booking.com, and extend to 183 days at companies like WorkMotion. Of the DAX-listed companies, Merck allows employees to spend up to 60 working days per year working from abroad, showcasing a more progressive aprpoach. Bosch closely follows them, enabling its 100,000+ workforce to enjoy workations for up to 54 working days.

Christine van Voorden, Senior Consultant Cross-Border Employment at Allianz, notes that their company’s threshold of 25 working days results from balancing employee preferences and compliance objectives.

Rather than on a mathematical exercise, it seems that employers indeed determine their company threshold on this pragmatic balancing exercise.

Implementing destination limitations on workations

In addition to a time limitation on workations, many policies impose restrictions on destinations. This limitation ensures workations remain an employee benefit rather than becoming a burden on employers due to compliance risks.

Frank Hohns, Head of Global Mobility at PwC, reveals that their temporary work from abroad policy is limited to EU countries. This approach coordinate with the well-aligned regulations within the EU, mitigating social security and labour law concerns. Employees at PwC are allowed to submit requests that exceed the duration or destination limitations, but these requests go through a separate case-by-case process.

Navigating tax and legal compliance risks

The key limitations of temporary remote work from abroad – duration and destination – are driven by employers’ concerns about compliance risks. Five primary risks are often considered to be most important:

Corporate income tax: The workationer might constitute a Permanent Establishment (PE) in the destination country.

Employment tax: The workationer may trigger the employer’s obligation to establish a payroll in the destination country.

Social security: The workationer may fall under the destination country’s social security scheme, leading to due contributions.

Labor law: Local labor laws could apply to the employment, in addition to or instead of the laws of the home country.

Work entitlement: Workationers might lack valid work entitlement in the destination country, potentially leading to illegal labor activities.

While some risks, like PE, remain ambiguous and situation-specific, employers often opt for a zero-tolerance approach. They emphasise strict compliance due to the disproportionate consequences of non-compliance.

Addressing work entitlement and visa challenges

One significant challenge is determining how employees taking workations should qualify for visas. Typically, there are three options here:

Qualification as tourists.

Qualification as business travelers.

Qualification as local employees in the destination country.

However, the last option can trigger unwarranted burdens for employers, thus reducing opportunities for workations outside the EU or EU citizens and in the EU for non-EU citizens. Specialist panelists at the event were divided when it came to the best option, but they were aligned on one thing: Collaborating in order to clarify these complexities with relevant institutions.

Data analysis on the demand for temporary remote work

The topic of temporary remote work from abroad presents two primary use cases. The most obvious case, according to Heiko Leitz from DB Schenker, are workations. This is where employees combine their vacation with working time.

Data gathered by WorkMotion from over 5,500 workation requests backs this statement. But beyond affirming the rising trend of temporary work from abroad, the data also unveils other interesting patterns. Take a closer look at the visual representation below for a comprehensive view.

Ditribution of employee requests vs nationalities of employees

The left pie chart shows the distribution of employee requests across various countries. Note that the dataset primarily comprises companies based in Germany, with over 80% of employee requests stemming from people employed, and therefore residing within Germany (depicted in yellow).

However, the right pie chart showcases the nationalities of employees making these requests. Although approx. 80% of requests come from individuals employed in Germany, only 45% of these requests are made by German citizens.

This shows an over-representation of non-German nationals who are working in Germany and seeking the opportunity to work from abroad for a short amount of time, represented in green.

Top Nationality-Destination Combinations for Workations

Going deeper again, the bar chart shows the top 17 combinations of nationalities and destination countries. The standout combination is German nationals choosing Spain as their preferred destination. Other favoured destinations for Germans include Italy, Portugal and France, as denoted by the yellow bars.

But it is also clear that international employees working in Germany and seeking workations tend to opt for their home countries. Indian nationals choose India, Italians opt for Italy and Spaniards return to Spain, etc.

Two distinct use cases for workation requests

The analysis above provides insights into the two main use cases for temporary work from abroad requests.

Firstly, Germans like to extend their vacations to Spain, but combining it with work and making it a workation. Secondly, international employees residing in Germany often want to and choose to visit their home countries with their workation benefits.

The data not only affirms the growing interest in temporary work from abroad but also reveals the different needs and wants in preferences and motivations among employees.

Using technology to automate and streamline processes

In the era of digitalisation and automation, companies are starting to leverage technology to streamline the process and management of temporary remote work. Companies like Personio and Allianz are adopting technology for tasks like online request forms and automated approval workflows. Not only does this help simplify processes, but also ensures compliance.

WorkMotion offers a comprehensive solution called WorkFlex, which encourages and helps companies to offer workations as an employee benefit. Their technology covers the entire process, from request to compliance assessment and approval.

Two years ago, workations were almost non-existent, especially in the German workforce. Now, they are a growing phenomenon as an employee benefit that requires companies to adopt technology in order to accommodate their growing importance.

Summary

The rise of workations as an employee benefit shows a huge transformation in the global mobility landscape. As organisations continue to shape their policies and embrace new technologies, they have to ensure they strike the right balance between employee desires and compliance requirements. That said, the future of temporary work from abroad seems promising.

With proof of a global mindset, companies make themselves ever more appealing to potential employees who want more remote work benefits. This also helps companies better find and develop talent and create a more diverse, inclusive global workforce.

*Content source: Workmotion

Author: Pieter Manden

Content Sponsor: WorkMotion